Options Simplified.

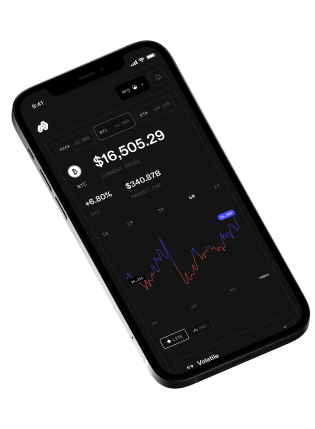

Arrow Markets is a cutting-edge options platform that revolutionizes trading by seamlessly integrating an innovative RFQ system.

Launch BetaSUPPORTED CHAINS

SUPPORTED CHAINS

Trade.

Compete.

Win.

Play Now00 00 00 00

Try our Contest

Unlock your trading potential by participating in our testnet trading contest. Practice your skills, climb the leaderboard, and win prizes along the way!

Unique

Features

Best Pricing

Mechanism

Arrow delivers highly competitive option quotes, ensuring DeFi users get the best possible pricing in the market.

Option

Recommender Engine

Arrow's beginner-friendly user interface removes complexity, welcoming traders of all skill levels.

User Driven

Community

At Arrow, our community is the heartbeat of our platform. We grow together, learn together, and drive the future of decentralized options trading.

Transparent

Experience the true essence of DeFi. Our platform's decentralized framework promotes transparency and user empowerment.